The EMH is False—Specific Strong Evidence

I am going to defend the following response to “If you are so smart why aren’t you rich?”: Rationalists actually are smart but we were way too modest and did not bet on our beliefs. The rationalists who actually tried to use rationality to invest often traded extremely lucratively. We should stop being so modest moving forward. Ideas have consequences, including for asset prices.

I will first present the best evidence I have that the EMH is quite false: There are currently high return trades (5% a month at least, possibly more) with extremely low risk (you can lose 1-2% max, probably less depending on execution). These trades take a little execution but do not require professionals. In the recent past, there were VERY simple bets that returned ~10% a month with even less risk. I will describe both these trades then talk about more speculative evidence. Be aware several options are geo-locked (in particular FTX blocks US IP-addresses. No exchange offers futures to traders in the USA).

By the EMH I mean this practical form: People cannot systematically outperform simple strategies like holding VTSAX. Certainly, you cannot expect to have a higher expected value than max(VTSAX, SPY). Opportunities to make money by active investing are either very rare, low volume, or require large amounts of work. Therefore people who are not investing professionally should just buy broad-based index funds.

I would say that for many asset classes you should have a reasonably strong prior that the current price is correct. I would include stocks and normal sports bets. However this prior is weak enough that the standard to overcome it is basically ‘convincing argument from a friend’. It is important to approach this with the same mindset you would use to make predictions and to be reasonably detail-oriented. I am not claiming this is trivially easy to beat the market just very doable.

Post Election Trump Betting

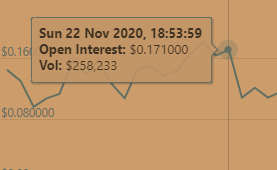

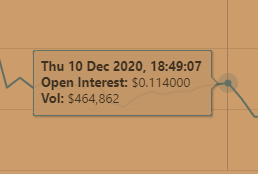

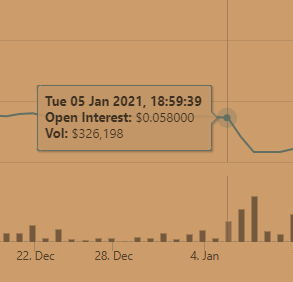

You could lucratively bet against Donald Trump long after the election on various platforms. The most lucrative way known to me was to short ‘TRUMPFEB’ on ftx.com. TRUMPFEB was a token that would pay out 1$ if Trump was president on Feb 1st and 0$ if he was not. The tokens were tradeable. Importantly you could short them to bet against trump. If TRUMPFEB was selling for 8cents and you short TRUMPFEB you would essentially be betting 1 dollar to make 8cents. Here is a graph of the price over time and some specific values.

Source images: https://www.coingecko.com/en/derivatives/ftx/TRUMPFEB

Roughly the markets thought Trump has a 15-17% chance until Nov 22nd, ~10-11% chance until Dec 10th and ~5-6% chance until January 5th. The odds were non-trivial until the electoral college met in person. You could short TRUMPFEB with 2x leverage which let you double your returns. You could have easily placed a million-dollar bet shorting TRUMPFEB long after the election. FTX was not available to Americans but you could have gotten somewhat less lucrative odds betting on Polymarket or catnip. Polymarket and Catnip were available to Americans. At least one rationalist I know made over 100k betting on Polymarket. The Polymarket election market had nine figures of volume. Predictit had low limits and high fees but many other platforms did not. In many countries, you could easily and legally bet with fiat.

Safe high return trades exist right now—Perpetual Future Arbitrage

This trade is harder to explain and trickier to execute but it does not require being a professional. A ‘perpetual future’ is a contract that mimics an underlying asset. You can buy them ‘going long’ or you can ‘sell’ them to other people by shorting. For simplicity, let’s talk about BTC and BTC-PERP. BTC-PERP is a tradeable asset that works as follows on ftx.com:

-- Ever hour compute the average prices of BTC and BTC-PERP over the last hour

-- If BTC-PERP traded higher then longs pay shorts. If BTC is higher than shorts pay longs.

-- The amount paid is 1/24th of the discrepancy (on Binance these payments trigger every 8hours and the payment is 1⁄3 the difference).

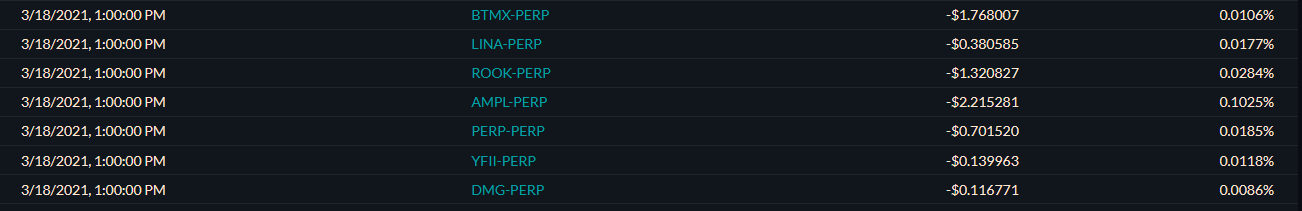

Here is what this looks like. The second to last is the ‘payment’ (negative means I got paid) and the last column is the hourly rate. (These are some example holdings, this is a real account but not a proposed portfolio):

The above account is short all the coins.

In general Perpetuals trade above the price of the underlying coins. The underlying reason is that it is much easier to use leverage when buying perpetual futures. This effect is especially strong if the market is bullish (as it is right now).

The way to make this into an arbitrage is to buy the underlying coin and short an equal amount of the perpetual. For example, buying Bitcoin and shorting BTC-PERP. Prices almost never differ by more than 0.2%.

The account above has a value of around 32k. If you add up the payments you will notice I received more than five dollars in one hour. That is 840 USD or 2.65% a week. This payment is a little better than I would expect going forward but if the market remains bullish you can get 10% monthly doing these trades. I would be surprised if you could not get at least 5% returns over the next 30 days. Returns were even better a few months ago. However, rates were sane until about three months and will presumably return to sanity one day.

For now, you can grab some safe returns if you do this trade skillfully. This is not as simple as ‘bet against trump’ and you probably need some python scripts to grab funding rate data since rates differ between coins and over time. You also need to be careful about how you enter and exit positions. There is some work involved here but it easily makes sense if you have decent amounts of capital to invest (or can somehow pool some capital). Several entities with large bankrolls are doing this trade right now.

However the ‘work involved’ does not explain why this has not been arbitraged away as predicted by the EMH. Many large players are actually doing these trades. But at least for now, the ‘smart money’ cannot close the gaps. Markets are often inefficient for a long time. Just to be clear this is dramatically more work than Biden betting (which was trivially easy relative to the returns).

Backtesting Rationalist Investing

Hopefully, the previous examples have garnered me some credibility because I am about to do something very dangerous. The perp arbitrage is current and I told people to bet on the elections well ahead of resolution (I told people to bet post-election on various discords). But I think one very obvious implication of ‘rationalist thinking’ was to bet on AI progress. It was especially clear you should do this after Alphago. Conveniently Alphago came out a little over five years ago so we can check the five-year returns of some plausible AI investments:

Goog 3x

Nvidia 15x

AMD 30x

Intel 2x

Tesla 14x

Microsoft 4.5x

Botz ETF (2.5x)

TSM 4x

Facebook 2.5x

QQQ (Tech sector ETF) 3x

ARKQ (ETF) 4x

SPY (Obvious control group) 2x

You can argue that returns are driven by ‘tech stocks did well’ but GPU stocks did much better than tech in general. And I do think its fair to assume a rational investor who was looking to bet on AI progress would have put some of their portfolio into GPU manufacturers once it became clear that the ‘more compute’ paradigm was going to be influential. Imo Alphago was a good time to be convinced of the ‘more layers’ thesis and at the time most big AI projects were trained on Nvidia GPUS.

Much has also been made of the fact that Bitcoin was mentioned very early on lesswrong.

I changed my mind, Now I’m feeling different

We were young

We were young

We were young, we didn’t care

Is it gone?

Is it gone?

Is it floating in the air?

I changed my mind

I changed my mind

Now I’m feeling differentAll that time, wasted

I wish I was a little more delicate

I think it us usually best to focus on the strongest arguments for your case so I won’t go into various weaker ones in any depth. But I will note it is possible to lend quite safely at high rates (~20% long term, often much higher APY short term). The ‘Equity Premium Puzzle’ is also a well known anomaly. It is very hard to explain why treasury bill returns have been so low relative to stocks for over a hundred years. I mention these as examples but I ask people to stick to object level counterarguments against my main points. I have been telling people how to beat the market for months. I am telling you how right now. So it doesn’t really make sense to make meta-arguments about how the things I am saying are impossible. The object level have been laid out.

I too once believed in the EMH but I changed my mind. The third virtue is lightness. In a few days, I hope to follow this post up with a sketch of what is still available, practical advice on amateur trading and various paths forward. It is worth clarifying that clear arbitrage is strong evidence against the EMH. But it is much weaker evidence that various high-risk trades are actually positive EV relative to SPY. However, once you think the EMH is false you should, imo, start looking at the other end of the risk-reward curve.

Notably returns for the safe trades I discuss more than compensate for any plausible counterparty risks on FTX. A 1% counterparty risk does not really change the analysis and there is no way a major exchange was 1% to lose your funds over a short period of time. Nor imo was there a 1% chance the whole crypto system explodes.

My own mistakes

I should have written about this much earlier. I did tell people to Bet on Biden pre-election but that post had many flaws such as emphasizing predictit instead of Polymarket. In addition, post-election betting was much more obviously lucrative than pre-election betting. The last few months have also been extremely lucrative because of the crypto boom. I talked about many opportunities on various discord but did not post anything systematic and did not post ‘Bet on Biden v2’ to lesswrong nor did I post about crypto. Regardless of the reception, this thread gets I should have posted the information sooner. It is notable many people thanked me for the ‘Bet on Biden’ piece and it really hurts me that I did not sound the alarm louder on later opportunities. I also believe I cost myself a large amount of money by locking myself out of good counsel. I can make various excuses but I will not do so. Maybe my living and family situations played a factor in my bad judgment. Regardless I strongly regret my behavior

- People Will Listen by (Apr 11, 2021, 4:51 PM; 85 points)

- Violating the EMH—Prediction Markets by (Mar 28, 2021, 4:05 AM; 40 points)

- 's comment on People Will Listen by (Apr 13, 2021, 11:01 AM; 3 points)

- 's comment on Worth checking your stock trading skills by (Nov 11, 2021, 11:52 PM; 1 point)

- 's comment on Are there opportunities for small investors unavailable to big ones? by (Apr 15, 2021, 8:43 PM; 1 point)

Since we’re discussing EMH and VTSAX, seems as good a place to add a recent anecdote:

Chatting with someone, investments came up and they asked me where I put mine. I said 100% VTSAX. Why? Because I think the EMH is as true as it needs to be, I don’t understand why markets rise and fall when they do even when I think I’m predicting future events accurately (such as, say, coronavirus), and I don’t think I can beat the stock markets, at least not without investing far more effort than I care to. They said they thought it wasn’t that hard, and had (unlike me) sold all their stocks back in Feb 2020 or so when most everyone was still severely underestimating coronavirus, and beat the market drops. Very impressive, I said, but when had they bought back in? Oh, they hadn’t yet. But… didn’t that mean they missed out on the +20% net returns or so of 2020, and had to pay taxes? (VTSAX returned 21% for 2020, and 9.5% thus far for 2021.) Yes, they had missed out. Oops.

Trading is hard.

I think you need to follow good practices. Getting out with no plan is not following good practices. I will write up my opinion on best practices soon. Though it is nothing too crazy.

For precisely this reason, I’m fairly certain Bogleheads-style investing has the highest expected value for most people. The core philosophy of the approach seeks to minimize behavioral pitfalls while maintaining satisfactory outcomes. It’s surprising how infrequently it’s discussed here. (Perhaps it’s because we’re more a community of optimizers than satisficers?) On that note, the Bogleheads theory forum is excellent if you’re looking to learn more and develop the ideas further.

Why not S&P500?

You can’t buy the S&P 500, at least not directly. Instead, you can buy funds that try to match the performance of the S&P 500 (while charging a small fee), like VFNIX and VOO.

VTSAX by contrast, doesn’t track the S&P 500, but this isn’t necessarily a bad thing. From the Vanguard website,

In other words, it’s more diversified than an S&P 500 fund.

Yes, right, so to continue this line of thought: since more diversified means less risk, Gwern would want to buy VTSAX if he needs to spend that money in a relatively short time horizon. If this isn’t the reason, though, from what I gathered from a personal finance book I read years ago, funds tracking S&P500 always outperformed funds tracking the entire U.S. equity market over long periods (is this actually true?). So I was curious about why Gwern made such a choice in case the reason I hypothesized (he is investing money he potentially needs shorter-term) was wrong and there are actually good reasons to buy funds tracking the total US equity market even when saving long term.

This discussion is mostly irrelevant in practice, since the two funds track each other extremely well.

Even if it’s true that the S&P500 has beaten the overall market in the past, I doubt it’s statistically significant. Theoretically I can’t imagine a good reason why the optimal investment answer would be “pick roughly the top 500 companies, but not exactly those, but something like that picked by a committee of people you don’t know, in proportion to their market cap.” VTSAX just seems simpler as it tries to approximate “pick every company in proportion to their market cap.” This is also what the one mutual fund theorem in portfolio theory says one should do (if one limits oneself to US stocks only), so it has solid theoretical basis, unlike the S&P500.

I didn’t know this, now it makes much more sense, thank you.

I haven’t heard that claim before. My understanding was that such a claim would be improbable or cherrypicking of some sort, as a priori risk-adjusted etc returns should be similar or identical but by deliberately narrowing your index, you do predictably lose the benefits of diversification. So all else equal (such as fees and accessibility of making the investment), you want the broadest possible index.

I think this points to two very important things about investing and trading regardless of EMH.

psychology of the person

We tend to note the loses we avoided (that is the money we kept) much higher than the gains we missed (the money we actually lost by not playing in the game).

Unless someone has a good plan for how to manage and overcome those two aspects of their own mind I suspect they will find it difficult to ever commit to any investing or trading program/strategy. It will not take too much to push them back into the behavior reflected in your comments.

Is there a reason you only invest in the US stock market and not the whole world (VTWAX)? Or is VTSAX good enough and it’s not worth the effort to decide whether you should globally diversify and in what proportion?

I knew someone was going to ask that. Yes, it’s impure indexing, it’s true. The reason is the returns to date on the whole-world indexes have been lower, the expense is a bit higher, and after thinking about it, I decided that I do have a small opinion about the US overperforming (mostly due to tech/AI and a general sense that people persistently underestimate the US economically) and feel pessimistic about the rest of the world. Check back in 20 years to see how that decision worked out...

Thanks. I’m just trying to understand what people’s reasons are. My portfolio is also US-weighted more than market caps would dictate.

EMH requires liquid markets where you can’t cheat. Buying non-US stocks may be putting you on the wrong side of an inefficient market.

That’s an interesting argument I hadn’t heard before. It makes sense, although I think this argument can at best be used to rule out stocks of developing nations. That still leaves developed nations. So one might then diversify their stock holdings by adding some, say, Vanguard FTSE Developed Markets ETF (VEA) in addition to their VTSAX/VTI.

One argument is that the US stock market already contains a lot of global exposure as many/most large US firms are internationally diversified themselves. Buying global funds means you’re actually under-investing in the USA relative to the world as 40% of your “US companies” are actually global companies.

I don’t vouch for this argument, it’s just something I’ve heard which sounds somewhat plausible.

I’m not a fan of this argument because even if you have some global coverage, why not get more and reap the benefits of diversification? It’s like saying hey I already own 2 car company stocks, there’s no point in owning all US car company stocks. Sure the stocks might move in tandem most of the time, but diversification allows you to reduce risk.

Hmmm. So I don’t think more global exposure = more diversified. What you should be aiming for is investing in each country/region in proportion to it’s share of the market.

Consider the following situation

The USA is 30% of global markets

A global index fund invests in world equities, putting 30% of it’s money in the US market

The US market is actually also 50% invested abroad

Hence the index fund is really only putting 15% (30/2) in the US and is underweighted towards the US

Out of curiosity, why a US tracker fund instead of a global one like FTSE all-world?

The GPU company increase is notable because the reason Nvidia and AMD have done well has little to do with AI. It’s almost entirely about crypto, with some portion about video gaming. So while you would have done well if you had invested in GPU companies in 2015 because of AI, your results wouldn’t have actually been causally connected with your reasoning. If you take out Nvidia and AMD then your results are not nearly as much better compared to SPY. And I’m not really convinced that most of the rest of the tech increase has much to do with AI either, perhaps other than Tesla, although their increase seems more akin to Gamestop than to a company more based on fundamentals.

Of course, you could also have done better than the economy than by just investing in tech stocks, but that’s not nearly as much of an exciting conclusion (though still a bit of an exciting one).

However, that’s missing that the EMH is fundamentally based on risk—it’s easy to get better returns than the market, even over a five year time period, by investing leveraged. But then if the market goes down, it’s easy to lose everything. I haven’t calculated the numbers, but I suspect that someone who invested leveraged from 2015 to 2020 would have been looking great in January 2020 and then be bankrupt in April 2020. Tech has a different risk model than investing leveraged, but it definitely is higher risk than the overall US economy..

You can beat the market by investing in a high risk market, but that’s literally what the EMH tells you, so it’s a boring conclusion.

This is right. For people who do not know, you cannot actually use AMD GPUs for deep learning (at least not productively, AMD is trying to get there though), so AMD’s rise has little to do with AI.

You can sorta—as long as you don’t need specific CUDA features. I’ve generally had good experiences running Github pytorch/tensorflow code on RoCM. Though that’s on a Radeon VII, which isn’t sold anymore and was basically “datacenter GPU for home use”. My impression is that AMD have actually gotten worse recently at supporting deep learning on home GPUs, so maybe this is true nowadays.

I tried to bet on this on Polymarket a few months ago. Their native client for directing money into your account didn’t work (I think it was because I was in the US and it wasn’t legal under US law). I tried to send money from another crypto account, and it said Polymarket didn’t have enough money to pay the Ethereum gas fees to receive my money. It originally asked me to try reloading the page close to an odd numbered GMT hour, when they were sending infusions of money to pay gas fees, but I tried a few times and never got quite close enough. I just checked again and they’re asking me to send them more money for gas fees, which I should probably do but which is a tough sell when they just ate the last chunk of money I sent them.

I assume the person you’re talking about who made $100K is Vitalik. Vitalik knows much more about making Ethereum contracts work than the average person, and details the very complicated series of steps he had to take to get everything worked out in his blog post. There probably aren’t very many people who can do all that successfully, and the people who can are probably busy becoming rich some other way.

Not Vitalik. A friend of mine from OBNYC.

I don’t know why you had so many troubles putting money into polymarket a few months back. Right now polymarket is in ‘trouble’ since ETH fees are so high so its expensive to withdraw.

I mostly election bet elsewhere but I got five figures into polymarket without too much trouble.

I wish you had posted on lesswrong. I would have happily helped you.

I could have imagined this was true a month ago, but then I spent about 15 total hours learning about Ethereum financial widgets, which was fun, and wrote it up into this post, and now I totally understand Vitalik’s steps, understand many of the possible risks underlying them, and could have confidently done something similar myself. Although I am probably unusually capable even among the LW readership, I think many readers could have done this if they wanted to.

Similarly, I don’t know anything about perpetual futures, but I guarantee that I could understand perpetual futures very clearly by tomorrow if you offered me $20k (or a 20% shot at $100k) to do it.

Having to think hard for a week to clearly understand something complicated, with the expectation that there might be money on the other end*, is definitely a convincing practical explanation for why rationalists aren’t making a lot of money off of schemes like this, but it’s not a good reason why they shouldn’t. Of course, many rationalists may not have enough capital that it matters much, but many may.

*It’s not like these are otherwise useless concepts to understand, either.

It’s worth noting that doing Vitalik’s steps is one thing. Figuring out to pay taxes on the trade and how that effects the trade will be much more complicated.

I think by far the easiest way to trade the US election (for non US persons) was on FTX www.ftx.com

For reference, this is Vitalik’s blog post about the US election prediction markets (which of course favors Ethereum-based platforms!) https://vitalik.ca/general/2021/02/18/election.html. It looks horribly complicated. Maybe Vitalik himself didn’t know about FTX?

Side note: for US persons, www.ftx.us is available (but more restrictive).

https://ftx.com/markets/prediction has little markets and doesn’t look to me like it has markets that easily allow you to make tens of thousands of dollars with nearly no risk.

Back during November-January, FTX had a contract called TRUMPFEB that gave ~risk free ~15% returns in 2 months, up to millions of dollars (by betting against Trump to be president in Feburary). Right now the FTX OLY2021 market comes pretty darn close—you can bet hundreds of thousands of dollars on the Olympics happening at 76c. There is obviously the risk of the Olympics not happening, but I haven’t seen a good case for that risk being under 10%, making this a fantastic trade in expectation.

I agree and recommend this trade here: https://www.lesswrong.com/posts/MSpfFBCQYw3YA8kMC/violating-the-emh-prediction-markets

I think some markets are basically efficient and very difficult to beat. The public stock market is one. I’m not convinced by the AI example basically due to priors—we’ve seen many many people claim to be able to beat the public markets without special information, with evidence that seems much more convincing than this, and they are on average wrong. So I don’t think at least this argument overcomes my priors.

However less liquid markets are for sure beatable. The prediction markets around the election are one. Crypto is another—I personally have done well not just investing in crypto but by co-founding a hedge fund that has actively traded crypto for 3 years, many trades per day, making a trading profit (earning alpha) on 1081/1093 days. (And the losing days were all very small, each well below a day’s average profits.)

I also sit on an investment committee for an endowment and see what returns can look like in private markets where it’s possible to have a high informational advantage and turn that into outsized returns.

So to me, the EMH is mostly true for highly liquid highly accessible markets. But for illiquid, less accessible, lower information markets, there is money to be made for people willing to put in the effort.

Whether it’s worth the opportunity cost is also another question, it’s not like it’s hard to make money lots of ways if you are motivated and smart. Crypto is a fun hobby for me, like poker used to be, and I like to make money from my hobbies. Not everyone wants to spend their free time looking for EV in weird places.

This isn’t the right way to formulate an EMH. You can trivially get higher expected return than any investment by simply leveraging that investment. 1.1x leveraged SPY has higher expected return than SPY, and 1.2x SPY has even higher expected return and so on. As long as the borrowing rate is lower than the expected return on SPY, leveraging will always improve your return.

A better formulation would be that no strategy has a better risk-adjusted return than the market portfolio, which is the capital weighted portfolio of all securities held by everyone. If you restrict your investment universe to US equity only, the market portfolio is VTSAX (or SPY, they’re close enough). Then you could formulate the EMH as saying no portfolio of US equities will consistently outperform VTSAX in risk-adjusted terms, meaning, if we normalize the beta of the first portfolio to 1, then it won’t outperform VTSAX (which has a beta of 1 by virtue of being the market portfolio). Now my argument with leverage does not contradict this formulation, because a 1.1x leveraged VTSAX will have beta = 1.1. So if your normalize it to beta = 1, you get back VTSAX, which does not outperform VTSAX.

Maybe not what you meant, but this wording is too strong. If you leverage high enough to exceed the Kelly bet size by 2x or more, then your long-run portfolio value will be zero.

Yes, you’re right. I’ll weaken the claim to 1.1x SPY will beat SPY in expected return historically and in almost all reasonable contexts. Certainly often enough to invalidate the incorrect EMH stated above.

My statement was motivated by the single time period investment model, as is considered in the standard mean-variance diagram of modern portfolio theory. On that diagram, as long as the risk free rate is below the market portfolio, you can draw a straight line between them and once you go beyond the market portfolio, you’ll always have higher expected return all the way to infinity. But a single time period is not the best way to model long-term investing.

I see three things missing from your examples:

Taxes. Especially relevant if you’re trying to balance possible gains (taxable) against possible losses (which may not lead to corresponding tax reductions).

Counterparty risk. The more complicated the scheme, the more likely there’s some risk involved that you don’t understand.

Sudden regulatory changes. Eg, your government suddenly outlaws bitcoin.

The possibility that you’re just wrong. You might think that AlphaGo signaled good times for GPU manufacturers, but did you also think some years ago that the hype about nanotechnology could lead you to profitable investments? EMH advocates have never claimed that you can’t make money by investing based on your predictions about future technologies—if you happen to be right.

Returns for the safe trades I discuss more than compensate for counterparty risks. Of course, you will incur short-term capital gains doing these trades. But the returns I am describing are extremely lucrative and more than compensate for the tax treatment.

Do you do your own taxes? If so, how much more difficult do they become after all of this niche activity? How long did they take you to finish this year and last?

Counterparty risk and risk of extreme volitility in underlying are both very hard to estimate for crypto shenanigans. There’s also the chance of wiping out your principal with mistakes.

It seems deluk is investing with Bitfinex (blocked in US), which has lots of ongoing issues; see Patrick McKenzie on why the whole thing is a fraud that is down several hundred million and is likely to seize accounts https://www.kalzumeus.com/2019/10/28/tether-and-bitfinex/ .

IIRC some individual investors in Binance (also supposed to be blocked for US investors) were being targeted for investigation by CFTC; there’s an aspect of lending that lead to Know Your Customer violations (very hazy on specifics).

A legal way to put on this trade is to short MicroStrategy (Co that bought bitcoin) and buy bitcoin yourself. https://www.coindesk.com/microstrategy-bitcoin-michael-saylor-valuation

The exchange is mentioned in the OP and is not Bitfinex. Putting on this trade by shorting MicroStrategy and holding bitcoin is problematic if your broker doesn’t let you use your bitcoin to collateralize your MicroStrategy short.

Use isolated subaccounts, so that risks from trades in one account won’t affect the other accounts (although they’re still correlated). Whenever I set up a new long C + short C-PERP trade, I make a new subaccount.

Two issues with this post. 1) You have grossly underestimated your risk profile here. By way of example, in 2006 many financial institutions thought there was virtually no counterparty risk when dealing with large, established investment banks like Bear Sterns and Lehman Brothers. They turned out to be wrong. You imply that your “plausible” counterparty risk here is on the order 1%. Do you believe then that FTX is less of a source of counterparty risk than a large investment bank? Your position implies something like that. 2) There are multiple versions of the EMH, even if we allow that what you have shown here is a source of risk adjusted excess return, you would only be giving evidence against some variants of the EMH.

Saying that something is less than 1% to happen is not saying it’s impossible. If you hit the bad 1% you lose your investment. This is certainly possible. I am happy to take favorable bets even if 1% of the time I lose the entire investment. I am not going to bring down the financial system if I get unlucky. The risks on some of these are much less than 1% over the relevant time periods.

The point I was trying to make here was that your space of material risks and their probabilities are much too optimistic, so your presentation here is not “Strong Evidence” that the EMH is false. (I also mentioned that, your practical form of the EMH aside, multiple variants of the EMH make this a more complicated issue than you’ve presented, but I believe I get what you’re trying to say so that’s really just a minor quibble.)

In your second paragraph you state that there are nearly risk-free trades that net at least a 5% monthly return, i.e., an Annualized Return of: (1+0.05)^12-1 = 79.6%. That’s more than 10x the last century-or-so’s return on the US stock market. That would be strong evidence indeed but I don’t think you’ve shown that. Your prediction market and crypto trades are full of risks and frictions you haven’t accounted for and your AI trade, even if we generously grant that the outsized returns weren’t at least partially attributable to other factors, is only obvious in hindsight.

Regarding your underweighted risks, other commenters have aptly pointed out some of these, e.g., cryptocurrency volatility and trade execution risk, so I’ll just focus on the counterparty risk example I selected. I completely agree that you’ve correctly identified counterparty risk as an issue, but I believe you’ve underestimated the probability of loss as well as its significance.

Prediction markets, cryptoexchanges/platforms, etc. are new phenomenon relative to the traditional financial markets. These platforms continue to experience significant problems. Take for example the current ‘significant delays’ in withdrawing funds from places like Polymarket. Will all of these people eventually get all of their money back? Maybe, but even if they do that is still a loss in terms of the time-value of money. Or, more to the point, these platforms have a disturbing history of simply losing their customer’s money to theft or simple incompetence. I don’t know how I’d go about quantifying that risk for the trades you’ve presented, but 1% strikes me as quite low—just go look at Coinbase’s recent IPO prospectus. And that would be a total loss, not 1-2% as stated in your second paragraph; so you’re people leaving VTSAX behind better size their trades appropriately or else they face significant risk of being blown up.

All that said, I agree with the central tenent of your argument that for rational, informed investors it is sometimes possible to find opportunities for risk-adjusted alpha. I would add “provided they have good reason to believe they have some kind of edge” but that’s beside the point. I do not think you have at all shown that non-professional investors are not best off with dropping their money in a low-cost index fund and forgetting it for 30 years, i.e., that your formulation of the EMH is wrong.

You dont seem to be doing any sort of empirical calculation about how often things go wrong. Especially with respect to crypto exchanges. Exchanges have operated for many years. Users losing their funds is very rare. Empirically there is nothing like a one percent chance an exchange losses your money over a few months.

Another corollary statement: How do you make money from these trades? The only way this is possible over the long term is you are using information (whether that be facts or an algorithm) the parties on the other side of the trade don’t have.

The thing is, there is a certain stabilizing effect. There have been large funds that put together an algorithm and earned billions from the market. The problem is, over time each hedge fund as they win from their edge controls more and more of the funds invested into the market (~3 trillion at present). This in turn reduces the amount of gradient you can even extract value from.

Also, the way the big funds are doing it is not something an individual, regardless of where their personal intelligence falls, can replicate.

For the Perpetual Futures arbitrage, the return on investment is sensitive to the price difference between the future and the underlying asset. A price difference of 0.3% is needed for 10% returns per month (since 1.1^(1/30) ≈ 1.00318), while a price difference of 0.1% only gets 3% per month. I went on Binance and checked the spot price vs. the futures price for a moment in time; it was about $50 difference for BTC, or 0.085%.

So I am convinced that it’s profitable to arbitrage crypto futures; I predict the rate of return for the next 12 months at 10% − 40% (50% C.I.) with a median of 20% per year. There’s a chance of losing everything, but the expected value only decreases by 2% per 1% of losing everything, so as long as you estimate it to be small (<5%) and aren’t betting everything, the risk is manageable.

It seems doubtful to me that the 50% − 100% returns per year that you’ve experienced in the last month will be sustained for a year, and I wonder how it compares to other investments in crypto, both in expected return and in risk profile. Staking Ethereum gets 8% − 12% with little uncertainty, with the caveat that your money is locked up, so one gives up an opportunity cost to chase better investments. Investing in a basket of crypto or specific cryptocurrencies gives ??? rate of return; I think it would have much higher risk and higher returns compared to crypto arbitrage, so higher than the 18 to 20% I estimated for the futures arbitrage in the last paragraph.

In the previous sentence I compared a risky asset to a mostly risk-free arbitrage, and it might seem that’s there’s no principled way to compare the two, with the only commonality being both are in the crypto space. The assumption I make is that traders are willing to pay more for the futures for higher leverage, and that the market is efficient in some way, such that there’s a relation between the expectations of the rate of return of the traders and the price premium they’re willing to pay. So I still find some assumptions of market efficiency useful, even if the concrete statement of the Efficient Market Hypothesis does not hold.

I was quite explicit the current perp trade will only go on so long. You can lever the trade some amount to get to 5 or ten percent. Though there are limits to how much leverage you can use.

Imo you certainly should not compare a low risk investment to a plan that involves going long crypto.

Some random thoughts from a stranger on the Internet:

- The spot-perp difference is expressed as the funding rate (which is the way how perpetual swaps are pegged to the underlying, more long perp ⇒ positive funding ⇒ longs pay shorts ⇒ less longs, except in extra-speculative bullrun like recently). This mechanism has been working so far, because people are successfully massively arbing it!

- Binance has funding rate settlement every 8h, IF you had a constant 0.085%ROI, compounded 3x/day, you would end up with [insert LOT of digits]%/y. In practice, the funding is left-skewed, but not centered on that high value tho :/

(see https://www.theblockcrypto.com/data/crypto-markets/futures/btc-funding-rates for mean apy values)

- It’s basically doing a basis arb (long basis, to be precise), an interest rate arb with a variable rate (you play the yield). Arthur Hayes described it as the “NakaDollar floating rate bond” (see https://blog.bitmex.com/all-aboard/ he has been trading it since 2013, successfully is an under-statement)

-”There’s a chance of losing everything”: long spot/short future, if you don’t leverage it, you’re fully collat! You’re not long crypto, you’re literally delta-neutral

- Why such arb still exists (in a not-so efficient market—see https://www.sciencedirect.com/science/article/pii/S2214845020300673 for another piece of your “not sot” argument) ? Because of dollar-value (see Arthur Hayes post supra)

-Opportunity cost? Indeed, it can be quite huge, guess it’s a risk-profile discussion from there

-Comparing to staking : staking is cool, but, in terms of $, NOT delta neutral (you’re long eth!) - if the market tanks, your 12%APY in eth can be worthless (on nakadollar bonds, even if the settlement is most of the time in btc/eth/whatever, your ROI is in $, hence the name).

Ofc, dollar-value/inflation comes again into play then...

You’re claiming you’ve been correctly noticing good investment opportunities over a several month period. What has been your effective return over the last year (real return on all actual investments, not hypothetical)?

I feel like the strongest way to address the “If you are so smart why aren’t you rich?” question is to show that you are in fact rich.

My Vanguard has gotten a 30.4% return over the last year. I have a very simple, everything in the basic large funds strategy (I can share the exact mix if its relevant). Your advice is substantially harder to execute than this, so it would be great to know the actual relative return.

“You’re claiming you’ve been correctly noticing good investment opportunities over a several-month period.” This not what I am arguing. I am arguing that you can check the EMH right now and notice it is false.

The actual answer to your question is unfairly favorable to me given market conditions. I put a relatively large percentage of money into crypto so my overall portfolio is up more than 200% over the last twelve months. This is not replicable going forward. Pretty much everything in crypto is up but Solana started spiking later than other coins because of how it unlocked. I actually did tell people to but it when it was ~2 USD in early January and it has since gone up around 7x. That is less than some altcoins but as I said it starting spiking later which is favorable.

I am arguing that you can check the EMH right now and notice it is false.

The issue is that unknown “counterparty risk” term. As you do not know this risk—you have so far seen it to be zero but you do not have evidence it is actually close to zero—you do not know these bets are better than EMH. Or if they are, that they are going to be available for more than a brief period of time.

Buying securities on the public market via a reputable brokerage, the risk that your profile goes to zero because of any number of technical errors or fraud is very low. There are decades of examples of investors ultimately getting the market value of their shares at the point in their lifespan they choose to sell. This large number examples over a large period of time is evidence that the risk term is very small.

This ‘security’ does not exist for the commodities you are showing. Therefore if you take [observed returned] - [risk term], EMH says that this term is less than or equal to market returns.

You have not disproven it. You may ultimately be right but the evidence in front of you doesn’t show what you are saying. You need to wait enough years to collect enough evidence to get an accurate estimate of the risk term for these markets before you can make this conclusion.

Thanks for the reply! I find those numbers more persuasive than anything else. Well done!

How did you achieve 30.4? My time-weighted Wealthfront return for 2020 was 7.9%.

I currently have a roughly 50⁄50 split between VTIAX and VTSAX. I would of course not expect to continue to get 30% returns moving forward (I expect 5% return after inflation), but that is the figure I got when I selected a one year time horizon for showing my return on Vanguard.com.

If I instead compute from 01/2020 to 01/2021, I had a roughly 18% rate of return. I don’t know how your Wealthfront is setup, but I’ll note that I have a relatively aggressive split of 100% stock and nothing in bonds.

That’s a very selective term history; the exact bottom of the SP500 from Covid fear was March 20 2020, vs todays March 18th. Unless you put in everything on March 18th this is highly misleading. The true comparison would be your annualized dollar weighted average return (but for Schwab at least this isn’t easily calculatable, as saving is counted as increasing portfolio weight, and buying increases the base investment, but without a proportional change in ‘Total gain’).

Since 2000 the average annual return of the SP-500 is 5.9%(6.1% for VTI since inception) and a reasonable approximation of what would be earned going forward.

Is that 5.9% after subtracting inflation?

No, it’s lower than the normal “8%” you hear because I’m not averaging across time.

[+10%, + 1%, +9%, +20%, 15%] = 9% if you average the percentages, but this represents putting in $100 at the start of each year and selling any excess gains at year end. The way people invest of putting in $100 once and letting it compound* gives

1.1*1.01*1.09*1.2*1.15 = 1.6711662 total gain or

1.6711662^(1/5) = 10.8% annualized.

The technical terms for this is non-ergodic see https://jasoncollins.blog/ergodicity-economics-a-primer/ for a description.

*Actually people do even worse then this, particularly for hedge funds: individuals put money into hedge funds that recently outperformed but go on to reverse to the mean and underperform. So while the average annual returns are +30% −6% = 12% annualized, pretty good across time, but if you did 30% managing 100M and −6% on 1B then the dollar returns are net negative.

Picking a Schelling point is hard. Since the post focused on very recent results, I thought that a one year time horizon was an obvious line. Vanguard does note that the performance numbers I quoted are time weighted averages.

You are of course correct that over the long run you should expect closer to 5-8% returns from the stock market at large.

I can’t say much about other markets, but I do believe in the EMH is a reasonable approximation for the US stock market. The “obvious” rationalist investments into Tesla and AMD are an after-the-fact story to make it sound like that was the right thing to do back then. I’m sure one con construct an equally persuasive story for any other community of people. The pizza lover community will say you should have obviously invested in Dominos, and their stock has grown 25x in the past 10 years. Car enthusiasts will pick Tesla, etc.

Additionally, one prediction for a few years of returns is statistically insignificant. If you can today make, say 20, independent predictions about stocks that will beat SPY 1 year from now (in risk adjusted terms—after correcting for different risks), each of which has only a priori 50% chance of beating SPY, and then at the end of the year you’re correct on say 15+ of them, that would be statistically significant, for example.

I’m also unconvinced by this evidence. As other comments here noted, the rise of AMD and GPU stocks has very little to do with deep learning. What would make me more persuaded is if the author made specific public predictions about stock prices, with justification, and then analyzed it later.

In other words, I want to see what tech stock picks deluks917 currently thinks are undervalued. Then we’ll see if they’re right in a few years.

Hm it definitely does seem like there’s money sitting on the table on Polymarket. For example, will there be a recall election triggered for Governor Newsom is 90⁄10 even though 2.1 million out of the 1.5 million required signatures were submitted yesterday. It’s possible that some sort of shenanigans will prevent the recall election, but a 10% chance of that seems excessive. Someone wanting to make a big bet on this should probably lookup for the 179 historical recall attempts, what was the signature margin for successful recall attempts vs unsuccessful (in particular, what’s the largest signature margin that recallers claimed to have and then failed to actually qualify?).

I’ll look into this more, but the fact that it costs $120 in Etherium fees to try this out is just annoying enough to make me continue putting it off. Is Etherium likely to become useable again in the near future?

It doesn’t cost that much. i put some funds in polymarket and my total costs were around 18$, Use metamask and wait for a low=price time of day to send money. Alternately, use matic or something similar to get fees which are less than a dollar

I studied and worked in finance and I don’t think I ever met someone who truly believed that the EMH was the absolute truth.

There are plenty of plausible arguments against various formulations of it. However your statement is somewhat problematic: if someone is in finance, they would have to literally believe that their own actions are pointless in order to conclude that “EMH is the absolute truth”.

Few people have the lack of ego to properly consider that hypothesis.

Not necessarily. You can have people believe that EMH works in US equities or US Treasuries but not say, US corps.

But most people in finance that I encountered throughout my career believed that EMH did not worked in any market.

Another comment: does EMH guarantee market correctness now? Time matters. If you think about it—in fact this takes the shape of a proof:

actors in the market with a strategy that is more correct will over time accumulate more assets versus their competitors. Therefore, more of the assets used to buy the security will belong to “well informed, rational actors” and the price will converge over time to the one that “well informed, rational actors” collectively agree on. If this were untrue, it would require over an infinite timescale for irrational, poorly informed actors to statistically win and this is against the definition of (rational, information)

It’s a convergence. But this doesn’t mean it wouldn’t take 500 years to eventually stabilize, or that like all control systems, it won’t have random fluctuations and overcorrections. Example : classic PID control, where the system does converge on the target value, with an expected average value of the target even if it’s over/under damped.

Put this way it’s hard to understand a world where EMH could be wrong eternally. With that said, in near term views, traders can act to converge the market towards efficient prices, making a profit in the doing. It’s just a finite gradient to exploit—every new trader that is using the best available strategy is lowering the profits that can be achieved by the other traders using a similar strategy.

Hello,

Thanks for the detailed write-up. My experience so far is that if I explain this trade in excruciating detail to individual community members, they require more work from me than is involved in establishing a Cayman Islands limited fund before deciding that they don’t have time to read my emails because everything else they are doing has higher expected value, or they say things like “if such an opportunity really existed, mastrblastr would already have lent you seven figures, so why are you talking to me?”

As an aside, you probably do not want to do this trade with AMPL, because it is a rebasing token. The amount of spot you are long will change at the rebase. The amount of perpetual futures you are short will not change. This is bad.

Same for low liq on the spot leg (had the painful experience recently with tokenized stocks on FTX), you end up loosing a lot of %PA with slippage...

Worth noting that a new Metaculus market estimates ~50% chance of Polymarket being a counterparty risk in some sense 2021-2022.

The counter-party risk (either from hacks or scams) of FTX seems extremely low right now. The team behind FTX/Alameda has built flawless reputation in the crypto industry over the past few years, and is considered among the strongest technically. They basically went from non-existent to top ~3 of crypto exchanges worldwide in volumes in a matter of ~1 year. The recent growth in the FTT coin reflects this.

I think FTX will continue to grow in the next 6 months, as (1) crypto grows as a whole; and (2) FTX innovates and grows more than the competition.

For US residents, www.ftx.us is available (but more restricted).

Does FTX let you do the Perpetual Future Arbitrage trade on margin? I was seeing 20x leverage offered without additional fees on their website, that would come out to like 50% monthly gain, which seems batshit insane to me.

The short answer is no

It turns out that Biance is a lot less safe then assumed:

These leverage tokens do not behave how they should. Very few if any people should use them. But Binance did not lose use funds. If you were doing perp-spot arbitrage on Binance you were not at any risk.

note: the future-spot arb has indeed dried up.

Re BTC-PERP, looks like the funding has flipped negative for the last 24 hours or so: https://ftx.com/trade/BTC-PERP. There are plenty of altcoins with positive funding though, e.g. FTT

Crypto is not doing the hottest. But another part of the story is BTC is losing dominance. Though who knows what is about to happen.

I think it’s worth noting that there are often both fixed and percentage fees associated with crypto which it’s important to be aware of/minimize in order for the trades you mentioned to be profitable. Specifically:

Most exchanges charge a hefty %fee on trades. To get around this you want to buy on the pro exchanges (coinbase pro, kraken etc...)

Polymarket charges a 2% fee

I’m confused by this. Doesn’t this means that long positions almost always pays short positions, even if the index is increasing ? If so, why would anyone go long on the future ?

What’s the point of buying bitcoins in your scheme ?

“Every hour, each perpetual contract has a funding payment where longs pay shorts if perpetual is trading at a premium to index, and shorts pay longs if trading at a discount. This funding payment is equal to TWAP ((Future—Index ) / Index) / 24. ”

Source: https://help.ftx.com/hc/en-us/articles/360024780791-What-Are-Futures-

Regarding the claim that PERP contracts systematically trade above the spot, I’d say that in the past few months it’s been true for maybe 60% of the time? It really depends on the coin and the market sentiment. So the funding rate (which updates every hour) can vary a lot or even go negative (meaning that longs pay shorts) a few hours per day. I personally leave PERP contracts for short-term directional trades that I close in less than 24 hours. And so I’d do this arbitrage on quarterly futures [e.g. BTC-0326 is expiring in a few days and still trading at a small premium] so I can lock in the premium for the duration of the trade. At one point in the past few weeks, BTC-1231 traded 20% above spot! Which isn’t so unusual in crypto actually..

This seems silly. Perpetual futures generally trade at a much higher annualized premium to the underlying than quarterly futures. Also, quarterly futures regularly experience significant changes in the amount of contango, so it is possible to lose money if you are forced to exit early. Also, even if the amount of contango remains unchanged, if you are long the spot and short the quarterly, and the underlying goes up, you will have a negative USD balance that will either result in liquidation or paying spot borrow rates on USD.

So the quarterly version of the trade is a lot riskier and pays a lot less. Thanks.

Really good points, with which I agree.

Coincidentally, Arthur Hayes just wrote about this: https://cryptohayes.medium.com/all-aboard-4d50435190d6

In the interest of avoiding confusion and generally making clear what we are talking about, it would be better to frame this debate as being about passive investing, instead of the efficient-market hypothesis.

What the EMH means traditionally is that for some market, conditioned on some set of available information, the expected value of the future price is equal to the current price times one plus the expected discount rate; in other words: current prices reflect available information. This doesn’t need to be taken literally, but markets being efficient should mean that it is at least approximately true. What “the expected discount rate” means is unclear because, if nothing else, it depends on the preferences of the traders, but in any case we can probably agree that the discount rate on the typical large cap stock from 2010 to 2020 was not greater than 20%.

Market efficiency implies that no possible trading system can be expected to perform better than equilibrium returns.

Everyone on LessWrong knows that a sufficiently good superintelligence could have made much greater than 20% returns trading on a single large cap stock from 2010 to 2020. So for many markets for large cap stocks, the equality hasn’t been even very approximately true.

And it doesn’t matter whether the information set is just publicly available past stock prices, or all publicly available information. Also it doesn’t matter whether the AI has access only to information that is at least one year old; it can probably still make much greater than 20% returns.

So markets aren’t even close to weakly efficient in the traditional sense.

The traditional EMH (“prices reflect available information”) is still what most of the world thinks of as the efficient-market hypothesis, even if there are many people (not at all just rationalists) using the term to refer to the thesis of passive investing (something vaguely like: “it is hard to make risk-adjusted returns, after fees, that beat the market benchmark”).

It’s hard to exclude the traditional EMH on grounds that it’s meaningless, that it doesn’t have practical implications, or that nobody ever thought it was true, because all three of these things are false. If markets were superintelligent, that would have far greater practical implications than any thesis about how to invest our savings: financial markets would become the most important thing in the world, we would use them as an oracle to answer all our questions, solve all our scientific problems, etc. Knowing that they aren’t able to do that is important.