Maximizing Yield on US Dollar Pegged Coins

A Decentralized Finance (DeFi) Exercise

Over the last couple of months, I have been playing around Decentralized Finance (DeFi), a relatively novel application within the cryptocurrency ecosystem. In this post I want to illustrate how to use several DeFi applications to maximize yield on US Dollar pegged coins (stablecoins) without having exposure to cryptocurrencies volatility.

This post is advanced in its nature: To understand it, you will require an intermediate level of knowledge in DeFi and investment finance. If you’re keen to learn here’s how you can start:

Read this primer on Decentralized Finance

Deposit USD or CAD and buy cryptocurrency (For this exercise, I suggest buying ETH). I like Netcoins but something like Coinbase works just fine

Setup a wallet. I am very happy with Metamask

Learn how to use Polygon / Matic, a quasi Level 2 Ethereum solution

Learn how to use AAVE, a lending platform on Ethereum and Polygon

The first step is to get the amount you want earning yield in your Metamask wallet.

From there, open the Matic Network wallet and transfer the ETH to the Polygon / Matic network

The next step is to connect your Matic Metamask wallet to QuickSwap, and exchange your ETH to DAI. DAI is a cryptocurrency that is pegged to the US dollar, meaning 1 DAI = $1 USD

Finally, deposit your DAI in AAVE. This is where the fun begins.

Now that your assets are deposited on AAVE, the goal is to borrow USDC, another coin pegged to the US dollar. The idea is to do the following:

Borrow USDC on AAVE

Exchange USDC to DAI on QuickSwap

Deposit DAI on AAVE

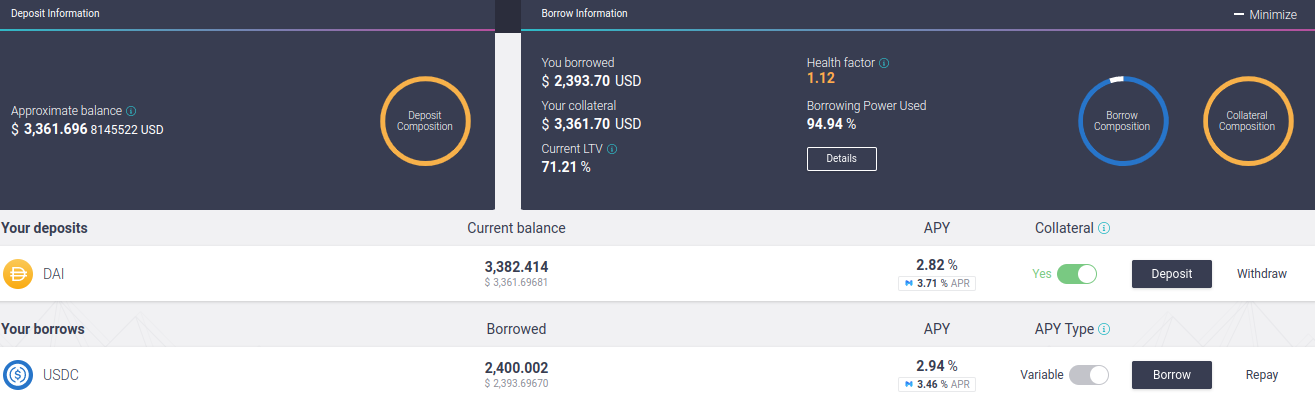

After repeating steps 1-3 eight times, this was the result:

What does this mean?

I have deposited on AAVE $3,382 DAI, earning 2.82% p.a on my deposit

I have borrowed $2,400 USDC, costing me 2.94% p.a.

I am earning 3.71% MATIC Rewards for my DAI deposit on AAVE

I am earning 3.46% MATIC Rewards for my USDC loan on AAVE

What are MATIC rewards?

MATIC is the native token of the Polygon / MATIC network. At the moment, I am being rewarded as an user of the protocol. The rewards accrue instantly, so for the purposes of keeping my cryptocurrency price volatility at a minimum, on an almost daily basis I will be converting my rewards to DAI and depositing them in AAVE.

What is my expected annual rate of return on this strategy?

For my deposit, I expect to make: $3,382 * 2.82% = $95.37

For my loan, I expect to pay: $2,400 * 2.94% = $70.56

My MATIC rewards for my deposit are: $3,382 * 3.71% = $125.47

My MATIC Rewards for my loan are: $2,400 * 3.46% = $83.04

$95.37 - $70.56 + $125.47 + $83.04 = $233.32

I deposited $990 DAI on AAVE, so my expected annual rate of return is roughly: 233.32 / 990 = $23.56%

What are the principal risks of this strategy?

The APY of my deposit and my loan deviate significantly. For example if my deposit APY goes down to 1% and my loan APY goes up to 5%, the strategy stops making economic sense. The upside is that this strategy can be closed as quickly as it was opened (20 minutes).

The MATIC rewards disappear. This would make this strategy uneconomical.

DAI coin loses its peg. This strategy mainly works because there is very little to no fluctuation between DAI and USDC. As long as the peg stays, there is stability in the strategy.

Your Metamask wallet gets hacked. Please make sure you set up your wallet carefully.

Although it looks complicated, once you get a hang of Metamask, Polygon, QuickSwap, and AAVE, getting this strategy in place is not that complicated. Once its up and running, you are welcome to either keep accumulating MATIC rewards (and add the price volatility of MATIC to your strategy), or periodically exchange MATIC to DAI. As long as the APYs stay close and the MATIC rewards continue, this strategy works and I believe it is great on a risk adjusted basis.

I expect MATIC rewards to be reduced slowly over time, so it is probable that my 23.56% expected annual return will be lower. However it sure beats the 0.30% expected annual return I am currently getting in my savings account.

For informational purposes only. This is not investment advice.

As far as I understand on average DAI is backed by 150% of other cryptocurrencies. What would happen with DAI if all other crypto-currencies would lose 90% of it’s value?

What are Matic rewards and what’s the economical motivation for them getting payed out?

fyi you can get around half these returns on aave on ethereum mainnet without having to mess with matic at all.

while i don’t think the matic team is untrustworthy, it’s worth pointing out their entire network is currently secured by an upgradeable multisig wallet.

there is also a ~1 week period to move back from matic to ethereum mainnet which can be irksome if you e.g. want to sell quickly back to fiat via some centralized exchange.

The problem with doing it on the Ethereum network is gas fees. Even with super low gas fees (~$3), this strategy would cost over$100 to implement.

I agree that doing this on Polygon / Matic is not ideal, as it is a sidechain / quasi L2 solution that sacrifices decentralization for speed and cost, but for illustration purposes, it works.

It takes ~40 mins to bridge Ethereum from the Matic network to the Ethereum mainnet,

ah yes, the proof of stake bridge is faster.

i guess it depends if you’re running this strategy with size. e.g. for over $100,000, 10% returns means you’d earn back gas fees in ~3 days.

You are picking up pennies in front of a steamroller.

Might be, but you ought to provide an explanation for the mechanics of it instead of a blank admonition.