We rarely think about where our stuff comes from or how it’s made. We go through our lives expecting that the things we consume are easily acquired. That is the beauty of modern society: supply chain logistics work so well that we seldom think about the consequences if these systems are disrupted. I think many of us thought about this for the first time during the COVID-19 pandemic. It was a wake-up call that revealed how fragile these systems could be, as it disrupted everything from basic goods to high-tech products.

Since the pandemic, I’ve become mildly interested in other supply chain vulnerabilities that could arise. Recently, I discovered one that is particularly concerning: the supply of semiconductor-grade quartz, which virtually all comes from one place—Spruce Pine, North Carolina.

What is semiconductor-grade quartz?

Semiconductor-grade quartz is a highly purified form of silicon dioxide (SiO₂), essential for producing silicon wafers used in microchips. These chips power the modern world, from smartphones to cars. Although quartz is the most abundant mineral on Earth, only an extremely small amount of it can be refined to reach the 99.9999% purity (6N) required for semiconductor production. The reason? Most quartz contains trace amounts of contaminants like iron and aluminum, which make it unsuitable for high-tech applications.

Currently, the only known deposit in the world capable of consistently producing ultra-high-purity quartz for semiconductors is located in the mountains surrounding Spruce Pine, North Carolina. Only two companies, The Quartz Corp and Covia Corp, operate in this area, tightly controlling the extraction and refinement processes.

To me, it is incredibly fascinating and at the same time concerning that such key material is only produced in one place by an oligopoly.

What are the alternatives?

As of now, there are no scalable alternatives to the semiconductor-grade quartz produced in Spruce Pine. Refining lower-purity quartz is possible but extremely expensive, requiring massive energy consumption and producing significant hazardous waste. Synthetic quartz is another option, but its production is still relatively small and expensive, with only a few companies in the U.S., Germany, Japan, and France producing it.

The Point of Failure

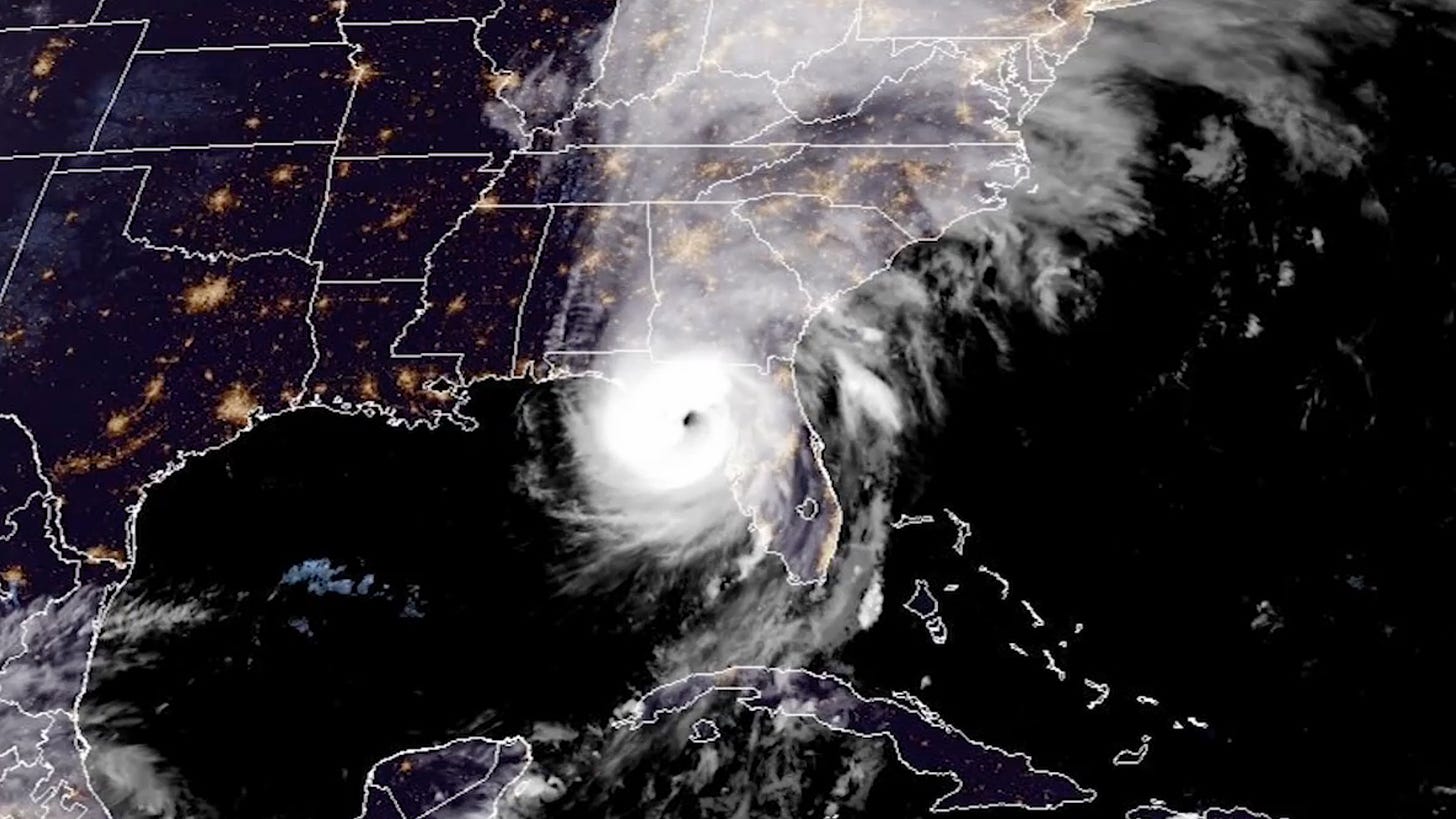

Why was I thinking about the production of this obscure material over the weekend? Spruce Pine, North Carolina is deep in the Appalachian Mountains of North Carolina, right in the path of Hurricane Helene. There is only one road that connects Spruce Pine with the rest of the world, which means any disruption to this road could impact the ability to transport this crucial material.

At the time of writing, I wasn’t able to find concrete information on the impact of Hurricane Helene on Spruce Pine specifically, but surrounding towns have already been devastated by flooding. As of now, it remains to be seen whether this hurricane will affect the production and distribution of semiconductor-grade quartz.

If the hurricane’s impact is severe enough to halt production for even a few months, we could see significant supply chain bottlenecks ripple across the high-tech hardware industry. Since so much of our modern technology relies on this material, any prolonged disruption could have far-reaching consequences for the global economy.

It makes you wonder: what other critical materials have such a significant point of failure?

If you want to learn more about this material and where it is produced, this excerpt from the book The World in a Grain by Vince Beiser is a great start.

A quick sanity check on the Chinese side of the web had revealed a couple of manufacturers for semi-conductor grade quartz, allegedly with manufacturing and processing centres in Jiangsu, CN.

My prior on this product type actually being a critical single point of failure is low.

See below: http://www.quartzpacific.com/api/upload/uploadService/dowloadEx?fileId=1113&tenantId=147391 ^Product spec (one of many semiconductor grade product shape) http://zj.people.com.cn/BIG5/n2/2023/0316/c186327-40338436.html ^investment news on new sites and manufacturing capacity

Do you have any references to quantity, rate of extraction/delivery, and downstream refinement processes? The book looks to be 6 years old, and likely took a while to research, so it probably describes a world that’s evolved since.

My mental model is that there are economic tipping points for both refinment of lower-grade materials and synthesizing the material directly that mean “uneconomical” is a point-in-time judgement, not a long-term stable impossibility.

Also, if it’s all that valuable, it seems unlikely that road disruptions will stop the flow—it could reduce and delay it by a bit, but for highly-valuable stuff, there are lots of transport options that can work, if the price is allowed to adjust.

I am with you, I have been trying to find more sources to see if semiconductor-grade quartz if being produced in places like Norway and Brazil, where deposits of high purity quartz are found. But from the research I have done, it seems that roughly 90% of semiconductor-grade quartz produced today is produce at Spruce Pine. Please let me know if you find any sources that say the contrary (I hope I am wrong honestly).

With respects to road disruptions, I agree. If it’s a matter of national security, stakeholders will do whatever is necessary to ensure the material is transported out. However road disruptions is one part of the equation. There are other scenarios to consider such as power issues and destruction of the refining plants themselves that we have to take into consideration.

High-purity quartz is used as crucibles in which to melt silicon for semiconductors. It’s not a directly consumed raw material. Based on my understanding of the process, the problem is that a little bit of the crucible dissolves into the silicon every time a batch is melted. How long does a crucible last, and can its life be extended by various forms of cleverness? If the lifetime of a crucible is longer than the time it takes to restore the mines to production, then the interruption might not be serious. Assuming that the mines produce extra-fast for a while, to make up for the gap in production, of course.

IIRC, this sort of interruption to chip supply has happened twice, once with a glue factory fire in Nagoya, and once because of floods in Thailand that simultaneously destroyed several assembly plants. Both interruptions lasted about four months before production was restored, and resulted in a brief price increase instead of the Moore’s Law price decreases that semiconductor prices usually enjoy.

Epistemic status: I was trained as an electrical engineer, and worked for many years as a chip designer, but have not actually been in the business in this century, so any detailed knowledge is possibly obsolete.

The existence of ultra high purity synthetic quartz is proof of concept that there is an alternative that is already viable, just not as affordable as high purity natural quartz, which limits its market share. A prolonged supply interruption may cause problems but only until someone picks up the resulting windfall opportunity for scaling up synthetic quartz production, and all the subsequent windfall opportunities for increasing its efficiency.

When there are big and glaring fragility problems it’s useful to ask where they come from. Sometimes it’s “The industry is too small to afford redundancy.” E.g. big car companies often just won’t move forward with a new component or material unless they have backup suppliers on deck to pick up any shortfalls, but aerospace doesn’t always have that option. Sometimes it’s IP law creating temporary bottlenecks. Sometimes its trade regulations or permitting rules that create lasting bottlenecks. But in time of great need the purely legal rules can be swept away, even if we often fail to do so when we should.

I bring this up because it suggests what directions for reform are likely to be productive.

Hunterbrook just came out with a piece alleging the damage at Spruce Pine is catastrophic:

https://hntrbrk.com/essential-node-in-global-semiconductor-supply-chain-hit-by-hurricane-helene-video-reveals-entrance-to-mine-has-flooded/

I can see how the article can be convincing. But it is worth it to keep in mind that Hunterbrook is also a hedge fund that trades on their own news—an obvious case of potential alignment failure if there ever was one. Though I am not sure if they are shorting this one.

Perhaps more damningly:

Per the Hunterbrook article.

PS: It is likely critical, but I am more uncertain about it being a single point. Unless we are limiting ourselves to the allegorical West.

Meanwhile, Twitter: https://x.com/deepfates/status/1840434157920641046?t=p5QVyXcUwIkL0v3pns8ADg&s=19