If you want to make a long-term bet one of your options is to register your bet with the Long Now Foundation as a Long Bet. They have some rules, which are roughly:

Both parties put up the same amount, at least $200/each.

Long Bets effectively runs a donor-advised fund (DAF).

When the bet concludes the winner chooses a charity to receive the money.

The charity gets the initial stakes, plus half the investment income.

Let’s say I claim we’ll have talking horses ten years from now, and you’re skeptical. You consider betting $1000 against my $1000 via Long Bets. If you win you’ll get your $1000 back, my $1000, and half the investment income which (figuring the stock market returns a nominal 7%) will be ~$967, for a total of ~$2967. On the other hand, if you had just put your $1000 in a DAF you’d have ~$1967. Is this a good deal?

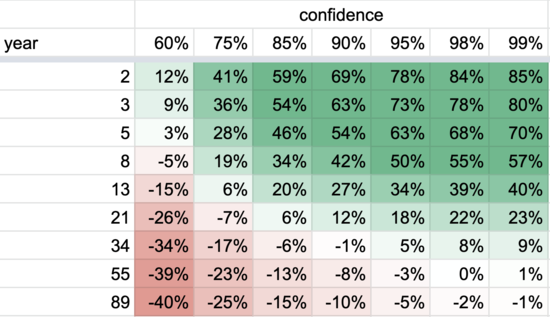

Provided putting the money in a DAF for at least that long would otherwise be your best option, if you’re 100% confident that (a) you’ll win and (b) Long Bets will still be around, then it’s a solid deal. You’re up about 50%. On the other hand, the less confident you are the worse the deal looks:

(sheet

you can copy and play with)

For example, at 60% confidence you’re neutral at 6 years, and negative after that. At 75% you’re down to neutral at 16 years. At 90%, 32 years. At 99%, 75 years. For an organization trying to promote long-term thinking, it’s surprising they would choose a fee structure that penalizes long-term bets so heavily.

Comment via: facebook

1. The calculation here seems to consider only

what would happen to your money if you don’t make the bet

what would happen to your and your counterparty’s money if you do and you win

but (1) if you don’t place the bet then presumably your counterparty will do something with that money (which might have value or disvalue from your perspective) and (2) if you place the bet and lose then all the money goes to your counterparty’s chosen charity (which almost certainly will have value or disvalue from your perspective).

Unless your expectation is that your counterparty’s chosen charity has negligible effectiveness (for good or bad) relative to yours, it seems to me that this calculation is unlikely to be the one you actually want to do.

2. My impression (which could be very wrong) is that making a Long Bet is usually at least as much about raising publicity as it is about directing money where you’d like it to go. It’s a thing pairs of people do when they want to get everyone talking about the issue about which they disagree. If I’m right about this, then in many cases the final disbursement of money is likely to matter less than the consciousness-raising.

Great point! I think this is often the case for bets between people who do or don’t consider effectiveness in choosing charities, or where people have sufficiently strong value disagreements that each thinks of the other’s charity as neutral, but you’re right that this is unusual.