Experimenting with pushing the non-Covid roundup on Friday instead of Thursday, and trying out dropping non-Covid from the title, and I plan to start pulling more focused posts out of the bank of written stuff in a week or two. Over time I’ll figure out how much belongs in a digest, how much is time sensitive, and how much doesn’t and isn’t.

Communication Styles

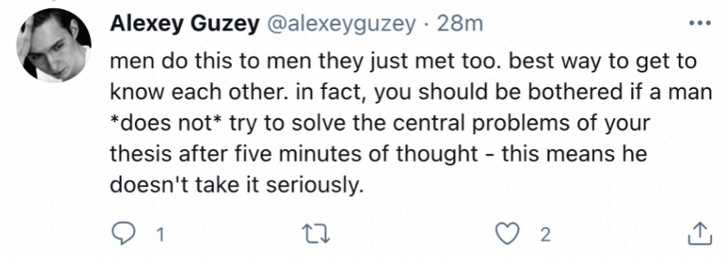

Alexey Guzey wants efficient communication.

One could respond that you have no respect for your time. Why is it obvious what you are going to say a third of the way in, yet you still say the other two thirds of it unless I interrupt you?

If the norm is ‘most of the time I will interrupt you first’ then of course that is fine. The problem is this is often considered super rude, and many people hate it. You cannot assume people will efficiently interrupt you, since the third possibility of ‘they don’t feel permission to do this’ also exists. Given that, perhaps check in a third of the way through until you know they’re not like that?

There is a key difference here.

Alexey is modeling this as ‘take an interest by exploring various intuitions and finding out what is hard or interesting.’ Amanda is modeling this as ‘the mansplainer thinks he has actually solved the problem.’

And yeah, if you are going in thinking you have solved it, that is not good. Stop it. If you’re learning and exploring the problem, because that is the curious and potentially helpful thing to do, then that is great on principle. The problem is that if it is interpreted as the other thing, then that won’t do at all, and you’ll need to stop it. Right now is a bad time, in general, for this move in these kinds of spots, even the good version.

When talking to me, yes, absolutely, if you are confident you know where I am going with something, or it would save time in expectation to ask if your hunch is right, or You Know This Already, please interrupt me. Then, if you are wrong, update on that. Unless, of course, I’m clearly having fun saying it. In that case let me finish, ya know?

Same goes for when there is something you disagree with. It is maddening to me when there are norms that one can’t note disagreement for fear of interrupting flow.

Strategic Use of Strategic Oil Reserve

Biden continues to release more oil from the reserve as of mid-October. More interesting is the plan to refill the reserve at $70. I went and checked, and we can totally could have done that when the announcement was made if we would like, all we have to do is buy futures out two or more years. I still have not heard a good argument against doing this. Yes, oil in the future is not oil now. Still seems way better than burning money by waiting.

Instead, we are giving the market a free put at ~$70 for the whole reserve, so that producers get the price necessary to justify drilling new wells. I do not expect this to

How expensive is doing it this way?

Two costs. One is that we give up our ability to get the discounts available through futures. A big lost opportunity, but not a cost compared to doing nothing.

The other cost is that we are going to overpay. Once oil companies know they have a free put at $70 they won’t use it until the otherwise fair price is below that. They can’t wait too long or get too greedy since the order size is very much not unlimited. I don’t know the market well enough to judge, but we could hope to get away with only overpaying a few dollars a gallon, perhaps.

The bigger hope is that this is looking at things the wrong way, and Biden chose this price because of cost of production. If American oil producers can pump out oil at slightly less than $70 a barrel then of course they will be happy to sell it at $70 and of course we will be happy to buy in order to induce production.

The problem is that it does not work this way. Yes, free puts at exactly cost of production are great. That does not mean they will be around when you need them. It could be revoked in the future, or space could fill up. Meanwhile, that $69/barrel cost has to be averaged out over many years. This will certainly help, perhaps quite a bit. Unless I am missing something big, it doesn’t solve the central problem, whereas buying long-dated futures would solve the problem. The oil company could sell its exact future production at a locked-in price.

Sports Go Sports

Article about the training of general managers in sports. Claims GM is the ‘perhaps the hardest job in sports’ which I generously presume doesn’t count the athletes. This is a great example of general business talk, of thinking a job is not about the thing it is obviously about. Yes, you have to mentor people and run an office that values transparency and worry about various interactions between players and blah blah blah. You can convince me of such things about the manager.

This is the GM. None of that is what the GM role is about or determines if you will be good. Being general manager is about making efficient use of resources, maximizing value and trading off short term needs versus long term needs. We know this because we have examples of terrible, simply awful GMs that cripple their franchises for years or decades (see: New York Giants) and they all have one thing in common. They make stupid, stupid individual value decisions. They trade down and reach in drafts. They sign free agents for more than they are worth. They don’t know when they are trying to win. They don’t think long term. They ignore the analytics. This isn’t hard.

We also know this because we have one example of the best GM ever, the clear GOAT: Billy Beane. While he has other skills everyone knows that what mattered was he had superior evaluation of value and player talent and ruthlessly moved up the value scale. Every success story is the same, you find quality players cheap, buy low and sell high. You can lose the team with synergy issues, I suppose, but you can’t win that way. Similarly, when the post talks about the few coaches who doubled as GMs, what do they care about? Player selection and value, finding the value, full stop.

Economic Growth and Well-Being

Vadim Albinsky at the EA Forum has a new analysis of the question of how much economic growth of nations improves the well-being of their citizens. There continue to be claims that the Easterlin Paradox applies, or mostly applies, and that life satisfaction does not increase with income on a nationwide level past some reasonable point.

The new post offers a rebuttal, summarized this way (from original):

Easterlin finds small coefficients in his preferred regressions of changes in countries’ happiness on changes in GDP. He concludes that these coefficients have low “economic significance” and that increasing economic growth is not a good way to make people happier. However, even if we take these coefficients at face value, they still represent a very meaningful increase in wellbeing within the effective altruism framework, consistent with the impacts of unconditional cash transfers on individuals. The benefits become very large when aggregated across all the people in a country for many years.

We also have reason to doubt Easterlin’s results, in that they are highly sensitive to small changes in methodology. We perform two variations on his regression that fully accept his methodology of only including “full cycle” countries, but update it slightly, reversing the result. If we replicate his results counting one more country as a “transition” economy, the Easterlin paradox largely disappears. If we repeat his analysis with new data from 2020 instead of 2019, the paradox also seems to largely disappear.

It may be difficult to find things we can influence whose change over time will have a higher correlation to a country’s change in happiness than changes in GDP. Even if we accept that boosting GDP does not meaningfully increase happiness, other potential means of boosting national happiness may increase it even less. If we rerun Easterlin’s analysis using three interventions Easterlin and Plant suggest (health, pollution, and a comprehensive welfare state), their implied impacts on national happiness are much smaller than the impacts for GDP or negative. However, I have low confidence in this conclusion, and think it is a very valuable project to identify the interventions that are most likely to have an impact on happiness.

Michael Plant, who was defending the Easterlin Paradox responds in the comments that it is now unclear if the paradox holds in full, but still claims the effects are insufficiently large to worry about prioritizing economic growth.

My response to the Easterlin Paradox involves a supreme case of Kettle Logic. I could probably come up with more, but here are seven claims.

The measurements are wrong, the real effects are large.

Even small measurements would be worthwhile because compound interest.

Well-being being measured here is not the proper core of one’s utility function.

Economic growth allows larger stable populations, which increases utility.

Economic growth matters for well-being independently of economic levels, and poorer countries tend to be growing faster.

Economic growth has many other important beneficial effects.

Advanced economies are currently doing some nasty things that greatly decrease well-being, that less rich countries are not doing. This is fixable.

Many of the underlying arguments are some combination of obvious (whether or not you agree), obvious once the premise is stated (ditto). Others are less so.

In part this section is a marker for something worth exploring at more length another time, where I could expand on these points. The last one to me is the most interesting. As economies get bigger, choices have tended to get made that interfere with the living of life. Barriers are put up to doing almost anything. Standards are raised, outlawing perfectly good solutions to problems. It becomes harder to have and raise children, and those children are given less and less freedom. People are taught to raise their expectations and standards, often beyond what is possible, and told to be unhappy about things all the time. Time honored means of being happy or at least content are discarded, without having good replacements available.

Does economic growth cause that? It certainly in some ways enables it. A huge problem with trying to prove something like Easterlin statistically is that there are so many huge correlations with economic growth that are not obviously causal or necessary.

Economic growth also enables, and goes along with, the plausible solutions to such problems.

Our Words Are Backed By Nuclear Weapons

Or are they? Swift Center asks when Putin would use a nuke. This is good use of forecasting, in the sense that they use some very good intuition pumps to pay to know what their forecasters really think.

(I will note that they underestimate the impact of events slightly, because they take the average expectation as their baseline, without accounting for the baseline risk knowing a given event didn’t happen is different from the baseline without knowing if the event took place or not. Small effect, still worth fixing next time.)

The core model is that if Russia uses nuclear weapons, it will be in response to losing territory, while being before it loses too much territory, in the hopes of freezing the conflict in place. Once things go too far, we have learned a lot about Russia’s willingness to use a nuclear weapon, and also there is not much territory left to save – it’s not like Ukraine is going to invade Russia – so the benefits of doing so are low, and they would only further endanger the regime.

The Efficient Market Hypothesis is False

Tyler Cowen makes it clear he agrees.

A few days ago I argued that believers in AGI should be “long volatility” in asset markets. Whether or not you agree with that exact prescription, why isn’t there an EA mutual fund, reflecting EA views of the world, whatever those may be? Maybe the fund would instead load up on semiconductor chips, in any case they could aggregate the debates from all those EA forums to make the better decisions.

Presumably EAers are morally obliged to set up such a fund? (I don’t mean that as sarcasm, maybe it really would be a good idea.) EA supporters then could invest in the fund and would over time have more resources to invest in other causes. The fund also could reflect their moral priorities, such as not investing in factory farms (I don’t think any real net loss of diversificatory power would be involved in such a decision.)

Alternatively, you might argue that EA has only moral insight, and no predictive superiority about what will happen at larger levels. That too is a plausible view, especially among non-EAers.

But it seems to me one of these should be true, either that there should be an EA mutual fund, or that EA has only moral insight, not predictive insight. Which is it going to be?

The derivation should be clear. If failure to beat the market in practice, with magnitude sufficient to make it a moral imperative to create a mutual fund, means someone only has moral insight, than that means anyone with any practical insight is then able to beat the market by a lot.

Thus, in this line of reasoning, the EMH is the same as the EPH, the Efficient Prediction Hypothesis, which says that no one can predict events better than the conventional perspective. Proving that the EPH is false can then be done any number of ways. I know you agree it is false, because you are reading this sentence.

Bad News

The Reset Button is remarkably popular.

It gets monotonically less popular as we go back in time. Going back is remarkably bad for quite a lot of the world. It is remarkably appealing if contained to America.

You can also use NEPA to sue essentially any federal agency over essentially any action they take. For example, if they want cease fining people? Want to stop building a wall? That requires NEPA review, says a new lawsuit that might well win.

The extension from ‘you can’t do that without review that takes years and might never be finished’ to ‘you can’t stop doing that without review’ seems like an important innovation here. Applying the rules to immigration seems relatively straightforward. The main purposes of such rules is to enforce NIMBY and to hate humans and civilization and everything that supports either of them. Forcing us to throw people out of the country more forcefully and with more cruelty seems less like abuse and more like the central point of the whole thing.

Crime situation in San Francisco seems pretty bad, as illustrated by latest store closure announcement.

New York City gets ice cream shop to accept cash payments after repeated fines.

Mayor Eric Adams stated in a press release that “Cash is king, which is why the Cashless Ban Law was passed to protect the unbanked and underbanked in our city.” He added that he hopes that Van Leeuwen serves as an example that the city “will not allow any business to take advantage of this vulnerable population or penalize customers just for wanting to use cash to pay for things.”

I notice I am confused how this constituted ‘taking advantage’ of anyone.

Also, if you’re unbanked, these prices are insane, skip the Van Leeuwen Ice Cream.

Tyler Cowen note on need to minimize the percentage of single parent families.

Single parent families can be disastrous. In Colombia the current rate of that is 84 (!) percent, in Argentina, Mexico, and Chile it is more than half. For India I see estimates ranging from 4.5 percent to 7.5 percent for single parent families. Hail the disapproving Indian auntie! Hail the “difficult” Indian mother who insists on a proper wedding and marriage for the family’s children. etc.

More generally, one might praise the general notion of “families that bust your balls.”

Ball busting is only as good as the thing that stops your balls from being further busted. In this case, the cause seems good. In general, one must be cautious.

Via MR, NFT royalties are unfair and not enforceable. Also one might say that given royalties get factored into prices and depress transactions and liquidity, which makes owning NFTs a lot less attractive, there is no reason to assume artists will net benefit from them. Solution proposed is in part to use high-water marks, something I have been in favor of on this for a while. What to me is missing from this discussion is the role of royalties as consumer protection. If every transaction requires a royalty payment, then it is expensive to fake transactions and engage in wash trading. Without such costs, given NFTs only have value because someone will pay for them, an outsider cannot know if they are buying something with real demand or being scammed. I find the Arthur Breitman response of ‘obviously no one should ever rely on such prices’ unconvincing, there are often not practical alternatives.

Thus, I’ve come around to some modest amount of royalty being actively good and am hopeful royalties, even though unenforceable, will survive because a place like Objtk will want to preserve the reliability of its pricing. We will see.

Good News, Everyone

As I keep saying, TikTok is Chinese spyware. Do not use or install it. Our continued indifference to this whole problem is kind of weird. From Forbes:

TikTok Parent ByteDance Planned To Use TikTok To Monitor The Physical Location Of Specific American Citizens

The project, assigned to a Beijing-led team, would have involved accessing location data from some U.S. users’ devices without their knowledge or consent.

This is easy for me to say, as TikTok would not otherwise be relevant to my interests anyway, for overdetermined reasons. Still.

Samo Burja makes an excellent point.

Mitt Romney famously implored young people to start a business by borrowing money from their parents. That was certainly not an in-touch or politically savvy kind of thing to say at the time, given the whole ‘not everyone’s parents have the money.’

It was still very good advice to those who are in position to take it. Giving your kid a business loan to get them started, even one with negative EV in terms of repayment, is an amazingly great investment in their education. I hope that some day my kids will remind me of this.

Grand Theft Education arrives at the Supreme Court, which asks questions that one would hope are answered by the t-shirt.

Scott Alexander presumably has an invitation to do Conversations With Tyler.

Women do not pay a “pink tax” where their products are systematically higher priced.

Direct links to CA Study and NY Study.

Conclusion seems like the right one:

Another note is that even if similar items have similar average listed prices, that does not mean similar prices are on average paid, if men do more or less comparison shopping and discount hunting than women.

Jordan Schneider reports that Biden’s new chip controls de facto forced every American in China’s semiconductor industry to resign on the spot on pain of losing citizenship, which all of them promptly did. Also that ASML and TSMC have cut China off. At first his instinct was that this completely kills the Chinese chip industry dead. On consideration he backed that up a bit.

While I Cannot Condone This

To my followers: Do better (video, 2:19).

The ultimate Robin Hanson take.

The week in Tory, as one man sees it.

I feel that the Robin Hanson tweet demands a reply, with what I thought was a classic LW-ism: “Humans aren’t agents!”

But I can’t actually find the post it comes from, and I think I actually got it from Eneasz Brodski’s “Shit Rationalists Say” video. (https://youtu.be/jlT3MeCzVao)

Does anybody know where it originated? (And what Robin thinks of the idea?)

Looks like some text is missing:

”I do not expect this to … How expensive is doing it this way?”